Get Started With

servzone

Overview

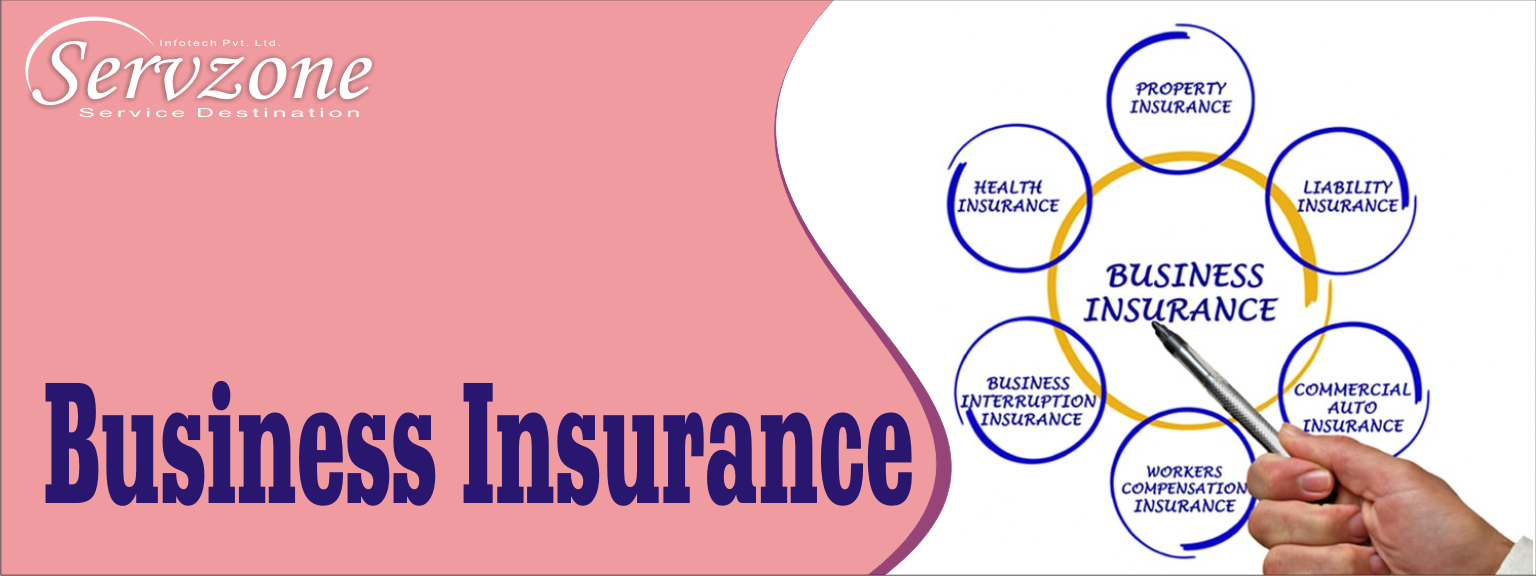

Business insurance is a type of insurance that helps an enterprise to protect its financial assets, intellectual property and physical location from force majeure resulting in huge financial losses. It supports the insured business against any damage or loss arising from incidents such as natural disasters, theft, vandalism, lawsuits, loss of income and employee illness, injury or death. These types of incidents can cause a big setback to your business.In many cases, this leads to partial or complete closure of the business leading to loss of income.

Advantage

It is important for the owners of small enterprises to carefully take care of the needs of their business and assess the wider financial risk in case of any loss. If the business owner does not feel that they have the ability to effectively assess business risk and require insurance coverage, they will have to work with an experienced, licensed and reputable insurance agent. Business insurance protects SMEs.From fire, theft, professional liability, general third party liability, compensation towards workers, medical expenses etc.

- Commercial Vehicle Insurance

Any vehicle that provides commercial services in a business must have commercial vehicle insurance. It provides protection from any damage to the vehicle or driver or in case of any unforeseen event like accident, accident, fire, theft etc. In India, third party insurance is mandatory for all vehicles on Indian roads. . But to ensure full coverage, business owners should opt for comprehensive auto insurance.

- Business Interruption Insurance

This type of policy is designed for a business that needs a physical location such as retail outlets. A business interruption policy is used in the event of loss of business due to uproarious circumstances for the normal course of business. For example, if a natural disaster or riot makes it harder for employees to come to work, it will hurt the business. This type of business insurance policy helps to compensate for such losses.

There are also a few other types of business insurance that are specific to certain kinds of businesses and are tailor-made for their needs. For instance, petrol pump owners can opt for Petrol Pump Insurance, restaurant owners can choose Restaurant Insurance and warehouse owners can choose Warehouse Insurance.

Types of Business Insurance:

There are many options for coverage for businesses. The coverage your business requires depends on things like the industry, its location, the number of employees, and the size. It is possible that as the business grows, your insurance needs may change.

The various types of commercial insurance policies are as follows:

- Liability Policies:

This policy helps your business to bear the cost of liability claims arising from third party bodily injury or property damage. If a lawsuit is arising against your enterprise, you may be liable to pay heavy legal fees. Without this cover, the entire cost will be on you. The most common liability includes general liability, public liability, commercial liability and commercial umbrella insurance.

- General Liability Insurance

General liability insurance is one of the basic business insurance policies that provides coverage against any liability costs arising from loss or damage to a third party or property. It bears the cost of any legal liability arising from a lawsuit that would otherwise have to be paid by the business owner. Whether you operate from a professional location or from your home, you should definitely have general liability insurance.

- Professional Liability Insurance

Professional liability insurance is the type of business insurance that provides protection against losses in the performance of a service. Also known as Errors and Omissions Insurance, it takes care of any loss you may suffer due to negligence in providing any services. Some insurance companies offer professional liability insurance that is specific to a certain profession. You can check with your insurance company which specific insurance suits your profession.

- Employee Insurance Policies

Also known as the Workers Compensation Scheme, this policy under company insurance helps the business owner to cover expenses arising from injury or illness to employees. It also covers the legal costs facing the business if a deceased family decides to sue the business. Even, in most countries, especially abroad, it is a compulsory purchase.

- Private or family trusts are not eligible to apply for Section 12AA registration.

- Property Policies

If a business is not adequately insured against property damage, the cost of recovery will be entirely on the owner.Commercial insurance helps the business owner pay repair or replacement costs of any damaged property. The risk is greater in the case of small business, where 40% of the business does not get a chance to reopen after a disaster. Therefore you need this policy to protect your business assets. This usually includes physical location of business, damaged equipment, documents, property or damaged due to the vandal.

- Cover for Loss of Income

This policy helps the insured to pay fixed costs if the business is unable to operate after a disaster.

- Product Liability Insurance

If your business is in construction, then product liability insurance is essential. This is useful in covering the costs of litigation arising due to damage to your products.

- Vehicle Insurance

Any vehicle used for business must be insured. In India, it is mandatory to have third party insurance, whether it is a personal or commercial vehicle. However, comprehensive insurance will provide self-harm as well as end-to-end protection. However, if employees are using their personal vehicles, their personal insurance will cover them during an accident or other loss.

Key Features

Though it is not compulsory to have your business insurance in India, but it is necessary. Business Insurance India comes with some special features that make your money worth policy:

- Property damage due to fire or natural calamities like flood, earthquake, storm etc.

- Loss due to theft

- Business insurance covers third party liability on business

- Injury or death of an employee is covered during his / her work

- It covers loss of profits after the outbreak of disaster

- Liability arising due to negligence and errors

Benefits

The benefits of Company Insurance plans are as follows:

- Company insurance scheme protects the business from losses caused by covering disasters like fire or natural disaster in the normal course of business.

- It gives credibility to the company by insuring its business

- Group policies are provided to assure employee safety and to help employers retain talent within the company. To a large extent, this helps the company's growth.

- These days customers also consider companies that are well insured with business insurance.

- Physical assets of a business such as computers, furniture, etc. are well protected from theft when covered by a business insurance policy.

How to Buy?

Buying insurance can be interesting only if you follow the right process. If you are looking for business insurance, you can buy either online or offline. To go online, you must know who all are selling business insurance. Go to the official websites and go through the plans in detail. If you find anything that suits your requirements, next go to the compare option. Here you’ll get a fair idea of how a particular plan works for your needs. you can get to know the different premiums and coverage offered by the insurers. The last step is to finalise one and pay the premiums online.It can be interesting to buy insurance if you follow the correct procedure. If you are looking for business insurance, you can buy online or offline. To go online, you should know that all businesses are selling insurance. Go to the official websites and see in detail about the plans. If you find anything that suits your needs, then move on to the next comparison option. Identifying here shows how a particular plan works for your needs.You can know the various premiums and coverage offered by the insurers. The final step is to finalize one and pay the premium online.

On the other hand, you can also buy offline by contacting the preferred insurance provider. This is the traditional way of buying insurance, which requires you to visit the branch, learn about the plans and buy. You can also go to an agent, as long as it is well versed with the product information and you are not being misled.

Important Things

When buying business insurance, there are a few special things to keep in mind:

- Assess your risks

Insurance cover is given after assessing the risk appetite of the applicant, otherwise, how will the insurer determine that they are going to cover your business? First, they estimate what the risk level of your business is. This is called underwriting where the underwriter reviews whether it will apply for all or part of the coverage. Every policy is premium and deductible.The premium is the amount you pay to take advantage of the benefits of the policy while deducting it, it is a pre-determined amount that you agree to pay at the time of the claim. Simply put, the less you pay, the higher your insurance premium or vice versa.

Therefore, only after assessing your risk, you can decide if you can deduct more to save on your annual premium.

- Shop around

Hopefully, whatever plan you take, buy it randomly. Shop around, do your research and buy. You can take help of online insurance aggregators in the process of suggesting schemes.

- Insurance Coverage

There is no doubt that the range of coverage varies from insurer to insurer. When purchasing business insurance, you can enlist the help of experts who really know the issues that your business may face and buy accordingly. Many times, insurance brokers can give you reasonable consideration. Whatever the situation, make sure that the coverage offered is appropriate to the insurance needs of your business.

Approve only one reputable agent

The principle of choosing a broker to buy company insurance is that it must be authorized or reputable!

Make sure that the person will give you enough information about the product as well as the correct pitch. He should be someone with whom you can overcome your doubts. If you cannot ask your family or friends using this policy. Visit and buy for online reviews of users.

- Review your insurance requirements

With your business, liabilities also increase. And you believed that the expenses being exposed during a disaster can drastically affect your finances. In addition, the cover you choose in the initial stage of your business may not meet current insurance needs. This is why it is necessary to assess the needs and tell the insurer if you want additional coverage.

Other Types

- Petrol Pump Insurance

This insurance is designed for petrol pumps, to provide optimal protection to assets inside petrol stations against the risks associated with CNG stations. This policy protects property, cash, property etc. against fire, theft, natural disasters, theft, legal liability, dishonesty of workers or other hazards. The premium for petrol pump insurance is calculated according to the values ​​and prices of property and machinery.

- Restaurant Insurance

Although not offered by many insurance companies in India, this policy covers your business against danger, fire, acts of God, malicious damage, riot, theft, property damage, loss of money, Is made for Lack of money during transit, physical loss of electronic equipment in the base, breakdown of machinery, personal accident, public liability and so on.

- Professional Liability Insurance

Professional liability insurance, also known as professional indemnity insurance, is designed to reduce the legal costs arising from professional litigation by third parties. If a third party endorses any injury, damage, or death due to services offered by professionals, the lawsuit is more likely. To bear those legal expenses, professional liability comes in handy. This policy can be availed by professionals including doctors,Lawyers, chartered accountants, architects, organizational bodies such as law firms, hospitals, BPOs etc. Some of the insurance companies providing professional liability insurance include ICICI Lombard, Bajaj Allianz, United India Insurance, National Insurance etc.

GST Registration

PVT. LTD. Company

Loan

Insurance